From Thesis to Transaction in Record Time

GrowthPal’s AI-powered M&A copilot helps you identify off-market targets, validate fit, and accelerate deal execution turning strategy into action within days, not weeks.

Proven Success

Join 125+ corporate development and strategy teams across the US, Europe, and Asia using GrowthPal to discover off-market M&A deals before anyone else.In just a few months, our platform helped enable 210+ LOIs and 42 closed deals - representing over $300M in pipeline value.

.png)

Feature overview

AI‑Powered Mandate Creation

Transform your acquisition goals into precise, data-driven mandates instantly. GrowthPal’s AI understands natural-language acquisition theses, analyzes industry, technology, and business-model descriptors, and enriches your mandates with actionable signals to help you source better deals faster.

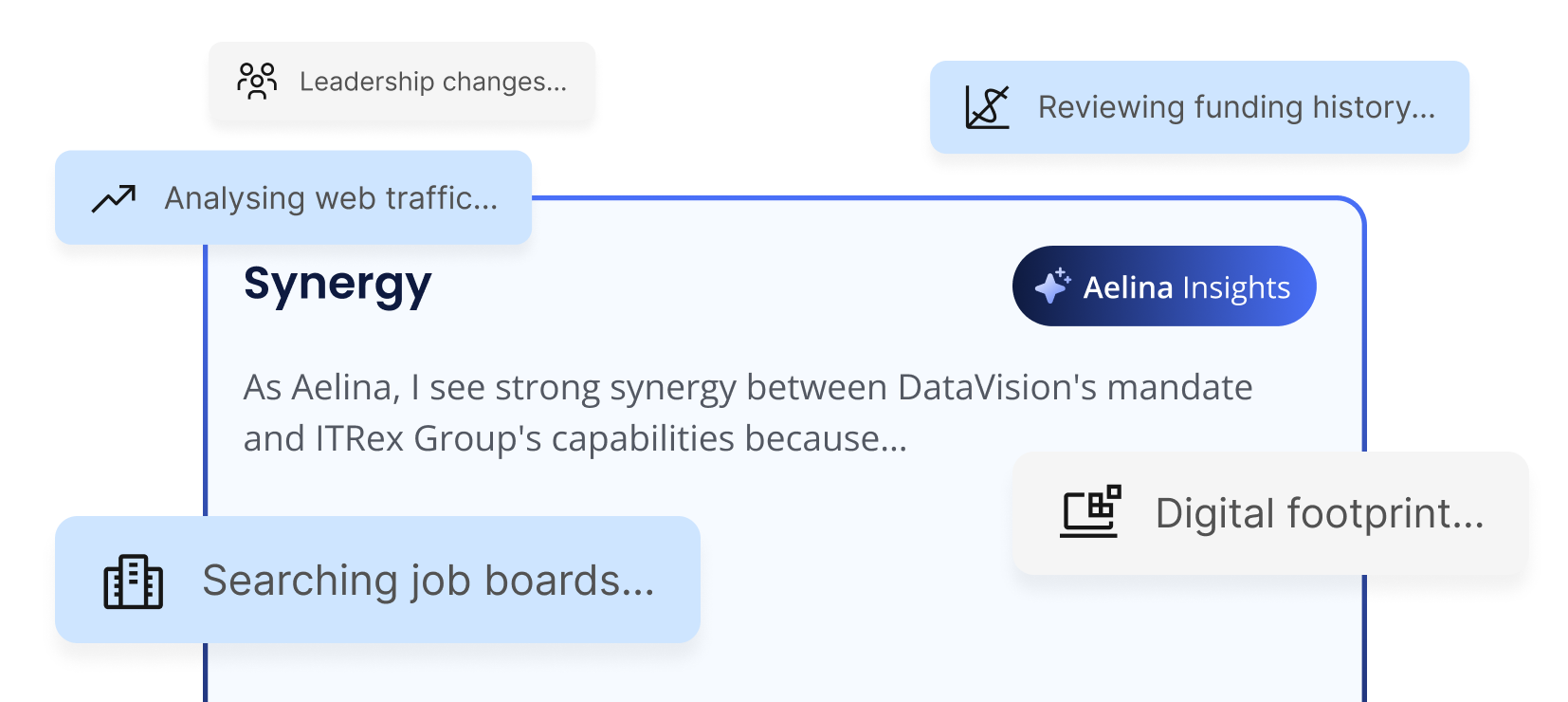

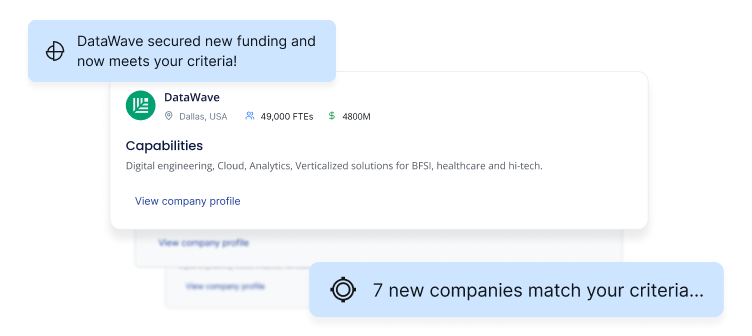

Contextual Discovery Engine

Identify high-fit, off-market acquisition targets with ease. GrowthPal’s Contextual Discovery Engine analyzes job boards, web traffic, funding history, leadership changes, founder digital activity, and more to surface actionable opportunities before your competitors do.

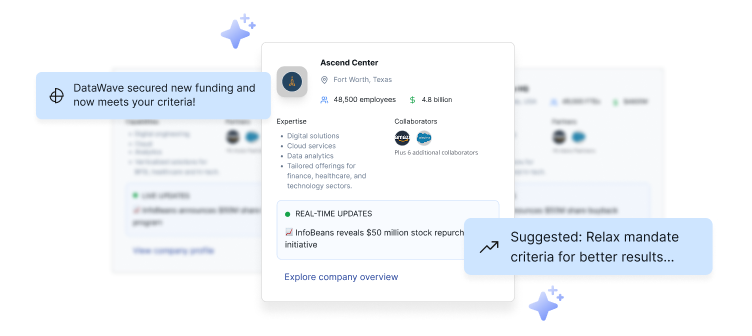

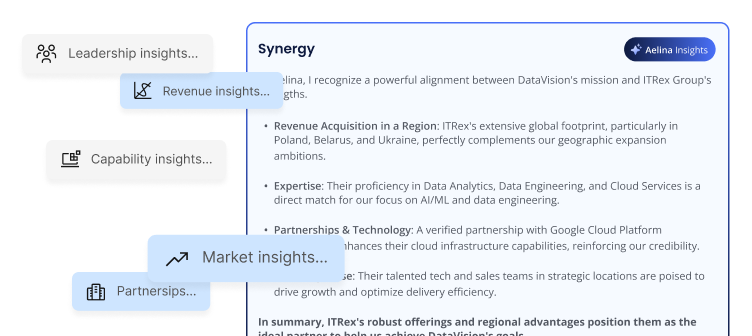

Growth Ideas & Predictive Insights

Unlock smarter growth opportunities with GrowthPal. Our platform analyzes market trends and sector movements to recommend expansion themes, adjacencies, and bolt-on acquisitions. Continuous scanning of competitive signals combined with your feedback ensures insights that evolve with your strategy.

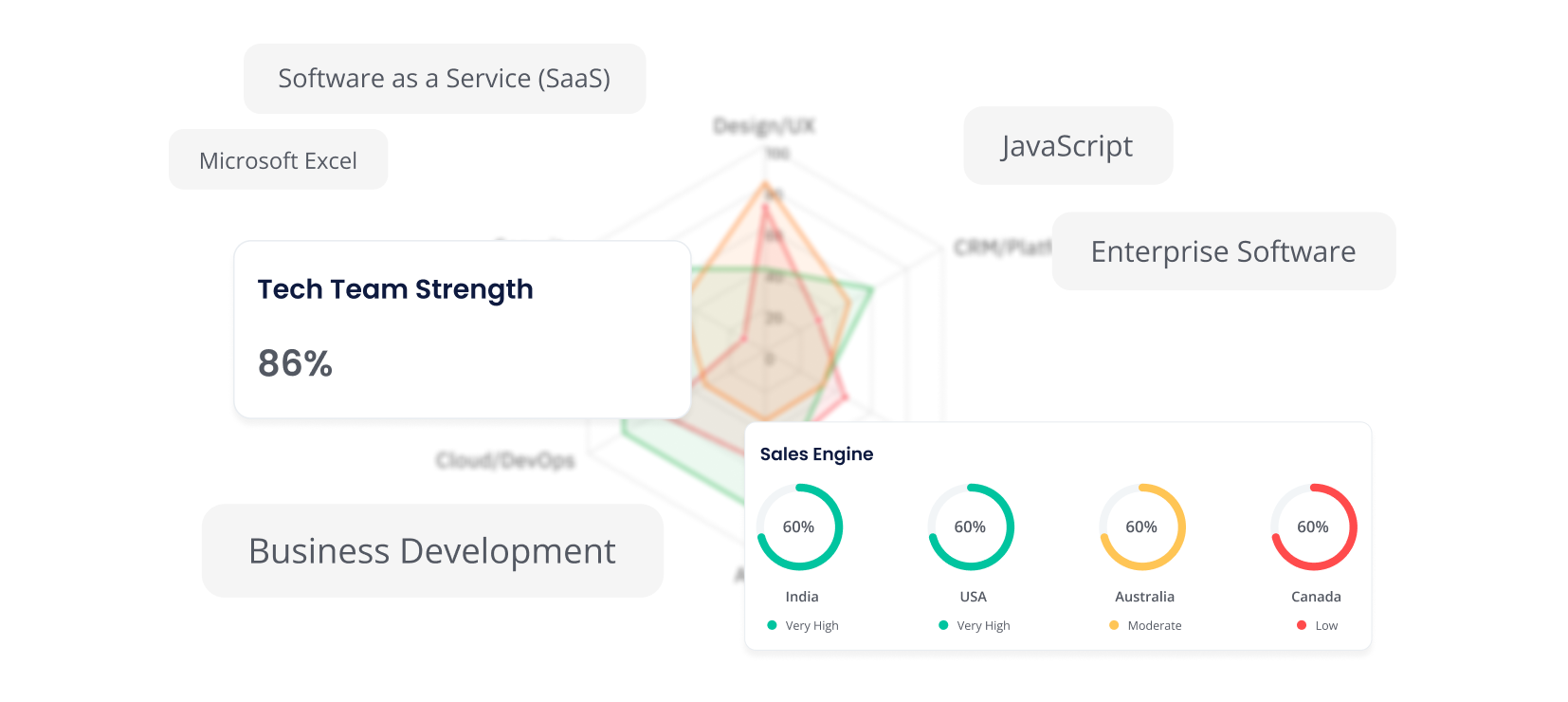

Deeper Company Insights

Make smarter acquisition decisions with GrowthPal’s comprehensive company profiles. Gain visibility into product and capability fit, customer overlap, team composition, and cultural alignment - providing the deeper insights needed to accurately assess strategic fit.

Human in the Loop

Combine the speed of AI with the judgment of human experts. GrowthPal’s AI shortlists high-relevance targets, and our analysts validate founder intent, market timing, and other soft signals. We help craft personalized outreach and introductions, ensuring you connect with the right decision-makers at the perfect moment.

.png)

Benefits

Boost Efficiency

Spend less time structuring mandates and researching. Natural‑language input and AI‑driven analysis eliminate manual work so your team can focus on negotiations and strategic decisions.

Increase Visibility

Obtain a 360‑degree view of the private market. Growthpal aggregates company profiles, market signals, partnership networks and intent indicators in one place

Drive Better Decisions

Predictive scoring and real‑time signals help prioritize high‑synergy targets and identify off‑market opportunities

Scale With Confidence

Whether you’re screening dozens or thousands of companies, Growthpal’s AI continuously learns from outcomes and adapts recommendations. It scales your pipeline without adding headcount.

How it works

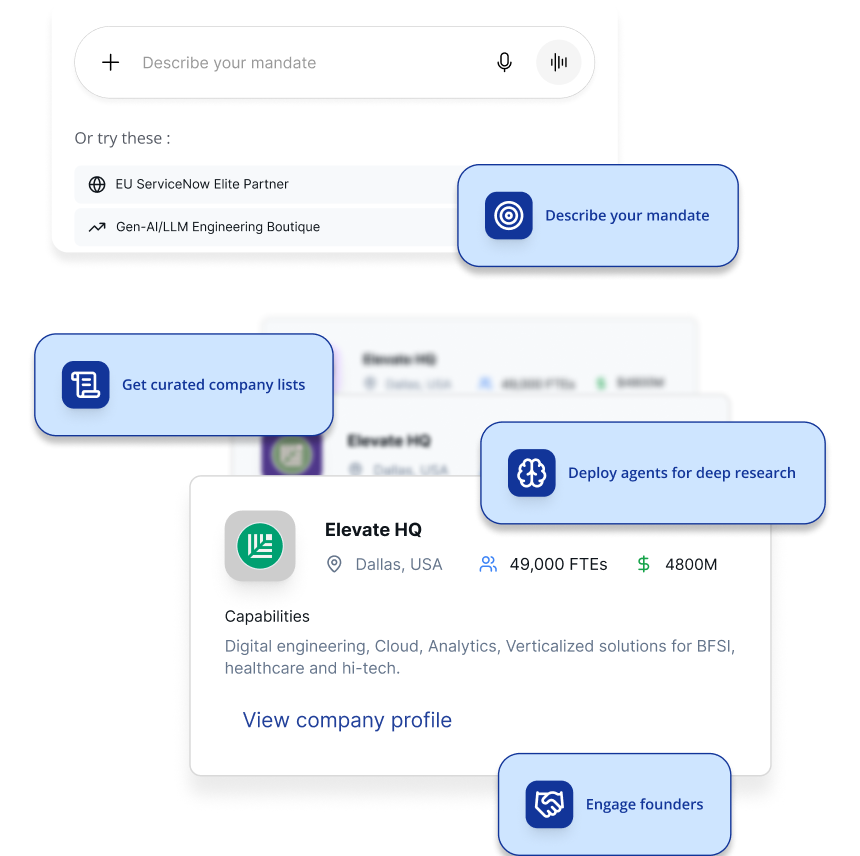

Describe your mandate

Share your acquisition thesis in plain English. GrowthPal’s AI interprets industry, technology, and business-model descriptors, transforming them into precise criteria such as sector, company size, and growth stage.

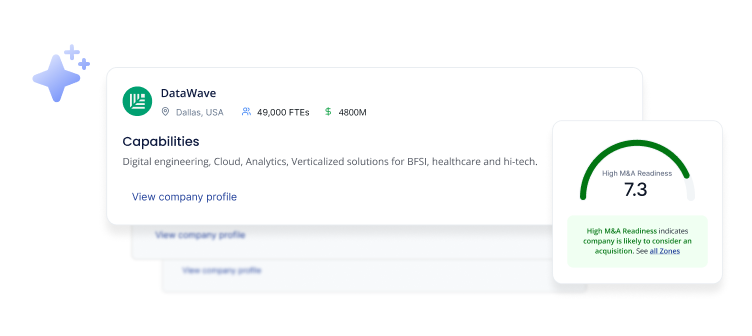

Get Curated Company Lists

Our discovery engine searches over 3 million companies across 60+ data sources. Within minutes, it delivers a shortlist of high-relevance targets that match your mandate.

Deploy Agents for Deep Research

GrowthPal’s agentic AI scores companies on product fit, capability overlap, customer synergies, team composition, and cultural alignment. Continuous signal scanning ensures your recommendations stay up to date.

Engage Founders and Close

Human analysts validate founder intent and market timing while assisting with personalized outreach. Integrated contact data and CRM workflows help you connect with the right decision-makers and move swiftly toward LOI.

Loved by Businesses of All Sizes

Built for Teams, Not Just Analysts

CXOs

Conduct landscape scans, prioritize deals and generate executive insights on off‑market opportunities.

Corporate Development

Enrich pipelines, source proprietary intel and coordinate due diligence with your team.

BizOps / Strategy Teams

Validate investment themes, track founder intent and prepare board‑ready briefs with Growthpal’s hybrid AI‑human workflow.

Stay Informed with Our Latest Blog Posts

Ready to transform your M&A process?

Growthpal turns deal sourcing into a fully AI‑powered copilot. Get early access today and move from thesis to transaction faster.

.png)

.png)