Strategic Acquisitions Designed for Confident Growth

Acquiring the right company should be a strategic advantage, not a long, uncertain search. GrowthPal’s acquisition framework helps you identify high-potential targets quickly and confidently by combining deep market intelligence with a refined buy-side acquisition search methodology. Through advanced analytics and a focused evaluation model, we support companies looking for strategic expansion, capability enhancement, or market entry.

Whether you're exploring roll-ups, tucks in acquisitions, or capability-driven deals, we ensure your journey moves forward with clarity and precision. With our experience in deal sourcing, analytics, and targeted outreach, you gain a structured pathway to build a strong acquisition pipeline that aligns with your long-term goals.

Why Strategic Acquisitions Strengthen Business Growth

Expand Market Share with Purpose

Acquiring a company helps you scale faster by gaining ready customers, operations, and deeper market access. With structured M&A advisory like ours, you can identify targets that strengthen your position and deliver measurable impact. Integrating a business with established revenue, brand presence, and market trust significantly reduces the time needed for organic expansion.

At GrowthPal, our approach focuses on opportunities that increase revenue, enhance customer reach, diversify offerings, and position you ahead of competitors, ensuring sustainable growth and long-term value.

Enhance Value Chain Through Right-Fit Capabilities

When growth depends on efficiency and control, acquiring the right capabilities can strengthen every step of your value chain:

- Strengthen value-chain control: Vertical integration improves upstream and downstream processes, enhancing cost efficiency and service quality.

- Boost operational reliability: Acquisitions improve supply-chain visibility, delivery strength, and overall operational stability.

- Find capability-fit targets: Through focused buy-side deal sourcing, we identify companies whose strengths align with your business model.

- Lower external dependency: The right acquisitions reduce reliance on third-party vendors and improve overall consistency.

Enter New Regions With a Local Footprint

Expanding into new geographies becomes easier when you acquire a company already rooted in your target region. Acquisitions give you immediate access to local talent, regulatory familiarity, and an established customer base, reducing entry barriers and risks.

Using our M&A deal sourcing platform, we find region-ready companies that match your expansion goals and cultural expectations. This helps you gain a solid foothold without long setup timelines, enabling confident scaling and faster global growth.

Accelerate Innovation Through Expertise or Technology

Innovation doesn’t always need to be built from scratch; sometimes, the fastest route is acquiring what already works, and here’s how:

- Strengthen product and tech capabilities: Acquisitions help upgrade technology, expand product features, and bring high-value talent faster than internal development.

- Use targeted acquisition models: Many companies rely on tuck-in acquisitions or bolt-on acquisitions to boost technical capabilities and speed innovation cycles.

- Find specialized expertise: We identify niche teams, product lines, or tech assets aligned with your development roadmap.

- Enable seamless integration: The right acquisition supports faster implementation, shorter time-to-market, and smoother operational alignment.

How We Streamline Your Acquisition Journey

Strategic Advisory Backed by Data

Our mergers and acquisitions consulting approach blends analytics with domain expertise to understand your goals and tailor recommendations precisely to your strategic needs. This ensures relevance at every stage of evaluation and empowers you to make confident, well-informed decisions supported by clear strategic insights throughout.

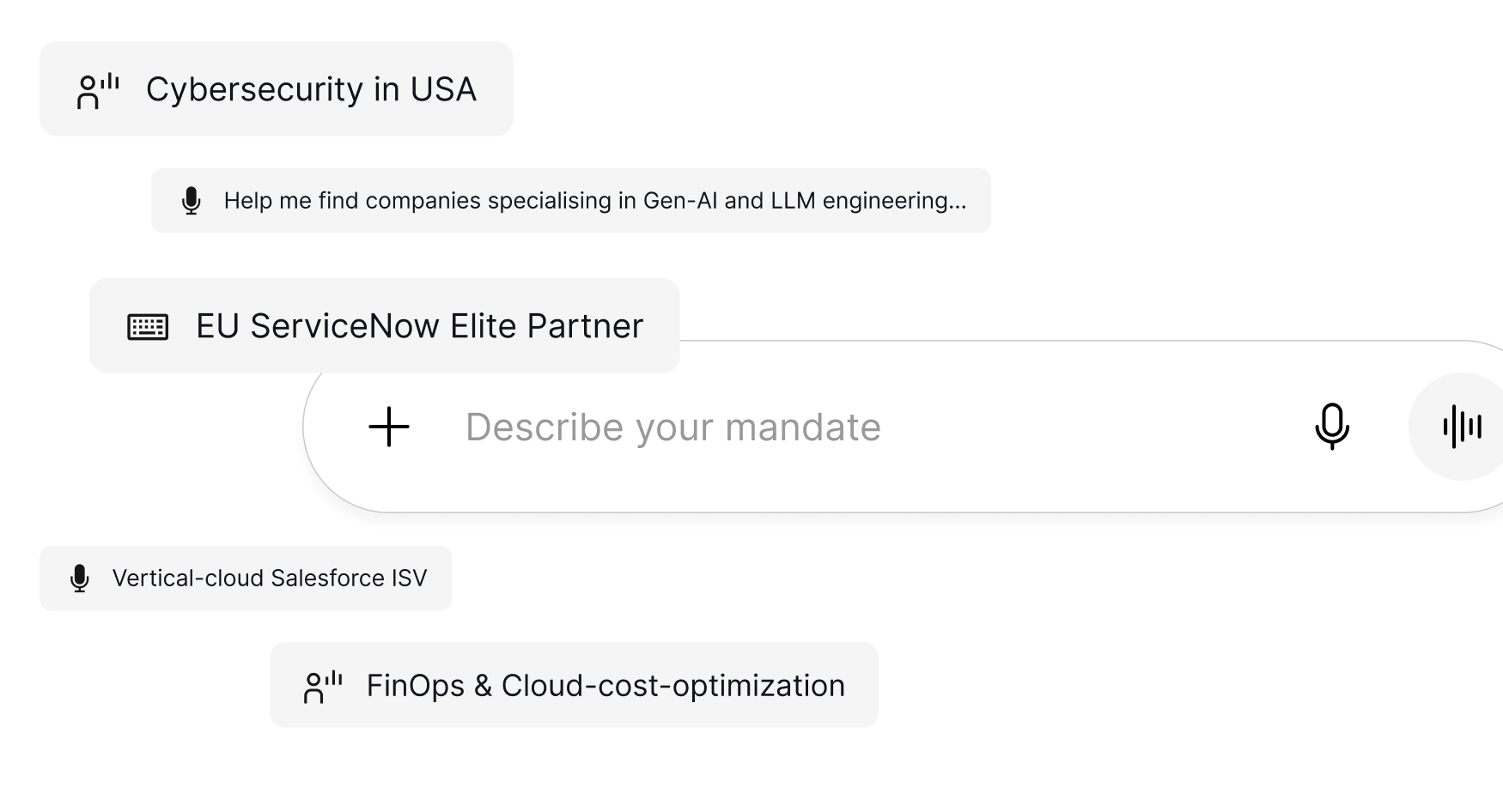

Curated Target Identification

Using refined M&A funnel sourcing, we match your requirements to measurable criteria such as capability alignment, founder intent, geography, and market position. This helps you focus only on high-quality potential acquisitions that genuinely support your long-term vision and create meaningful, sustainable business value.

Confidential and Efficient Execution

GrowthPal maintains complete confidentiality during outreach and validation. Our structured deal sourcing process accelerates decision-making, ensuring fast access to verified targets without compromising discretion or accuracy. This secure, streamlined approach protects your intent while enabling you to move swiftly and strategically.

Start Building Your Acquisition Pipeline Today

If you’re ready to grow through strategic acquisitions, whether through capability expansion, market entry, or bolt-on acquisitions, we are here to support every step with clarity and precision. Our refined M&A advisory and technology-backed buy-side acquisition search approach ensures you receive well-matched opportunities without the long timelines of traditional models. With GrowthPal’s mergers and acquisitions consulting expertise and a strong M&A funnel sourcing engine, you gain access to relevant, off-market companies aligned with your vision. Let’s work together to build a high-quality acquisition pipeline that fuels long-term growth and transforms your strategic direction.